A case of revenue sharing gone wrong

Tuesday night’s massive 12-player trade between the Toronto Blue Jays and Miami Marlins, essentially a salary dump thinly disguised as a baseball trade, should be a cautionary tale for the NHL and NHLPA when discussing one of the major sticking points in CBA negotiations: revenue sharing.

Don’t get me wrong, the NHL desperately needs revenue sharing. The top teams in the league — namely Toronto, Montreal and the New York Rangers — make a boatload of money, which drives the salary cap and salary floor up, making it difficult for the league’s poorer teams to get into the black. According to Forbes, 18 teams failed to post a profit in 2010-11, including the Pittsburgh Penguins.

It’s clear that NHL teams need help. Revenue sharing can help teams re-sign young stars, dip into free agency, and generally keep a competitive balance. Oh, and if every team can make money under a system, the chances of losing games to lockouts decreases. But without the proper limits in place, greedy owners can take advantage of the league’s generosity.

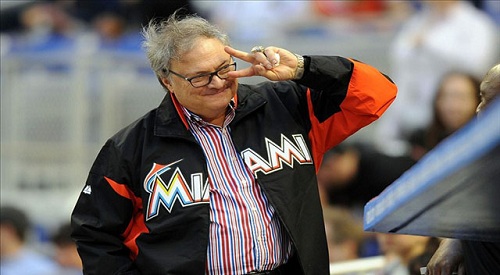

In 2012, Forbes reported that despite generating the least revenue in the MLB at $148 million, the Miami Marlins still turned an $8.9 million profit in 2011; only slightly lower than the New York Yankees (although that doesn’t include the money the Yankees received from the YES Network, which pumps the most money into the Evil Empire). This is because the Marlins owner Jeffrey Loria keeps a miniscule payroll (apart from last year’s mirage spending bonanza) and stuffs his pockets with the league’s revenue sharing – a strategy that dates back to his days in charge of the Montreal Expos. It has been estimated that the Marlins have made $300 million in revenue sharing since 2002 and have kept more than half as profit.

[php snippet=1]

The Marlins have lined their pockets for years while showing no inclination of putting a competitive product on the field. Their splash into the free agent market last year was nothing more than a ploy to draw fans to their new publicly funded ballpark, essentially a façade to help justify having the taxpayers pay the bulk of the cost for the new stadium. When the fans didn’t turn out in droves, the Marlins dumped any player with a price tag, along with their own credibility, if any remained. Just the Marlins being the Marlins.

Moreover, the two teams that posted the highest profits in 2011 were the Cleveland Indians and Kansas City Royals. Neither of these franchises make much through ticket sales, but still remain profitable because they keep a stack of cash from revenue sharing while skimping out on payroll. At least the Indians have made some effort to be competitive over the last two decades. The Royals have basically been a feeder system for the rest of the league.

Without a salary cap, the MLB, unlike the NBA, NHL and NFL, doesn’t require teams to spend a certain amount of money each season, so if owners want to put a terrible team on the field and keep all the league’s money, there is nothing stopping them.

But one of the problems in the NHL is that poor teams are being forced to spend too much money on players. Instead of being a percentage of the cap, the salary floor has always been a fixed $16 million below the cap ceiling. For plenty of teams losing money, that kills the bottom line. So even protecting against owners like Loria can cause problems.

It’s likely MLB would never have that problem because it generates so much more revenue than the NHL, thanks in large part to a TV deal that pays $12.4 billion over the next eight years. The NHL will make $2 billion from NBC over the next 10 years (although the renewal of a television contract with the CBC in 2014 is expected to raise league profits even more).

MLB is generating enough to make everyone rich. The NHL would like to make enough to have everyone break even. However, a better comparison for the NHL would be the NBA.

According to Forbes, Half the NBA teams lost money in 2010-11. The 18 NHL teams that lost money didn’t lose as much as the 15 NBA teams ($126.1 million vs. $175.5 million), but the 12 NHL teams that made money didn’t generate as much as the 15 NBA teams that did have numbers in the black ($252.6 million vs. $350.2 million).

With the NBA’s new revenue sharing in place, it is estimated that a total of $181 million will be redistributed in 2013-14, with two teams projected to receive over $20 million each and seven teams projected to take over $16 million each.

As a way to stamp out any prospective Jeffery Lorias, teams are required to spend at least 85 percent of the salary cap. Unfortunately, this would be even more prohibitive in the NHL than a fixed salary floor of $16 million below ceiling.

It is not all bad news, however. According to ESPN, the NHL owners are willing to increase revenue sharing to $220 million, closer to the $260 million Donald Fehr is asking. In addition to increasing the amount of revenue sharing, the league is also willing to allow former ineligible teams, such as Anaheim and Dallas, to receive payouts despite residing in large markets. Although nothing yet has been discussed (at least publicly) about forcing teams to spend what’s paid out.

Progress, however slight, is happening. And at least the bridge is being gapped on one core economic issue. But as baseball fans sadly realize, ensuring every team is profitable doesn’t necessarily guarantee a healthy franchise, just a healthy wallet for owners.

[php snippet=1]